Bitcoin / Gold Divergence has Widened Sharply

Trade opportunity? What motivates purchases of one compared to the other?

Should BTC / GC be regarded as a ongoing pairs trade?

As the world is flocking to BTC as something currency-like (although given consumer behavior, hardly anyone actually treats it like a currency), it does bear some similarities to gold.

Gold is an asset that is no-one’s liability, whereas the same can't be said of bitcoin. Bitcoin relies on others to continuously tend to the blockchain, and crypto of all flavors is unusable in the event of power outages. Further, the utility of crypto for small size retail payments and commerce relies on online payment mechanisms, similar to the payments infrastructure administered by commercial banks.

Both are in limited supply and require time consuming and costly efforts to produce more of it.

Bitcoin is trivial (although not totally free) to store, whereas gold requires thinking about storage and security concerns.

Bitcoin is easily dividable for small transactions, in a way that physical gold is not. However, there are gold analogs (“Goldbacks,” for instance, which purport to be small denomination certificates in which the gold is actually embedded in the certificate).

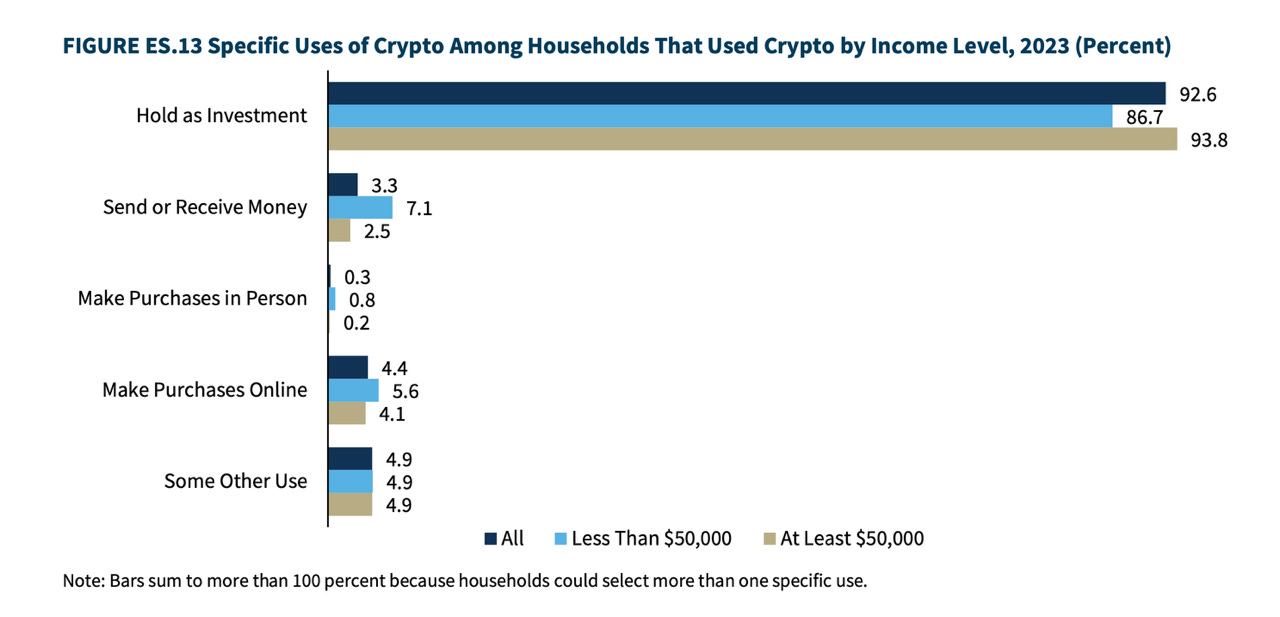

Bitcoin only has a modest utility in terms of real-world commerce, probably more so than gold, but according to FDIC survey data, bitcoin utilization is still trivial, and even mores if one excludes purely online transactions (such as for video game platforms).

Gold is routinely bought and held by central banks around the world as a reserve asset. Thus far, only El Salvador seems to be active with a well-publicized campaign to include bitcoin to its currency reserve position. Other central banks and Treasury offices hold crypto assets, but often as a result of asset seizures and forfeitures related to criminal activity.

Crypto exchanges have developed an extensive history of being untrustworthy, whereas physical gold can be transacted with regulated entities (including units of some foreign banks) that have a long history of stability. (This distinction may be less relevant if trades in BTC and GC are purely within futures markets).

Here’s a chart from this morning reflecting relative performance of BTC and gold:

Source: Bloomberg. The right-hand scale represents returns, and not prices.

Here’s the 2023 FDIC survey, which included details on crypto use: https://www.fdic.gov/household-survey/2023-fdic-national-survey-unbanked-and-underbanked-households-report Screenshot is from page 13:

Actual real-world purchases are significantly less than 1.0% by respondent (but not transaction size).

This is the website for Goldbacks:

. This YouTube channel decided to incinerate and refine some Goldback notes to see what the gold content actually is:

Is gold cheap with respect to BTC? Perhaps, but with some caveats. To the extent that gold prices are sensitive to geopolitical tensions, bitcoin hasn’t closely followed. Gold prices are weaker this morning following indications of a possible cease-fire agreement with Hezbollah, in conjunction with market participant discussion that there might not be continued escalation in military activity in Ukraine.

And what about liquidity? I’m limited in sourcing data on this, but it seems to be the case that proliferating activity in bitcoin ETFs is turning out to be a key liquidity source for traders of bitcoin, but these public vehicles still represent a tiny fraction of outstanding coins, whereas the physical gold market appears to be far more broad. The “bid/offer” spread for physical gold might be notably wider than for bitcoin, but the depth of the market is generally superior, and there is generally a consistent bid in the gold marketplace related to jewelry fabrication and technology applications. As of late 2024, jewelry and tech consumption accounts for the majority of mine output, and nearly 50% of total gold supply, including recovery and recycling of gold-rich scrap.

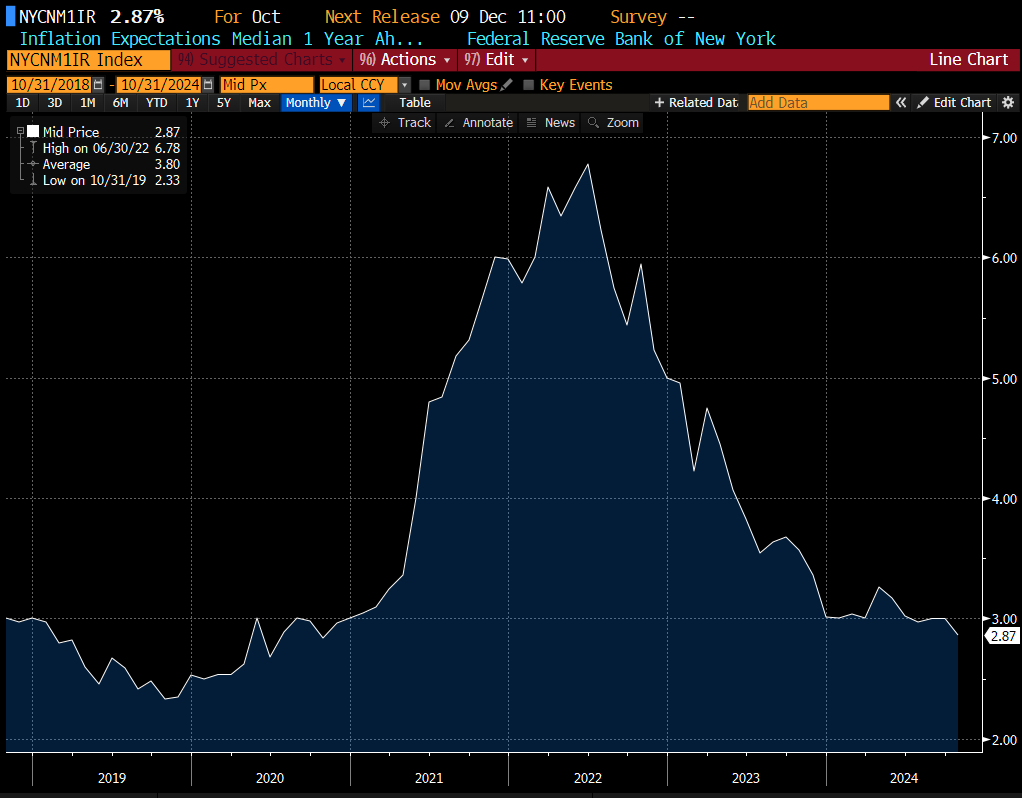

I’m not particularly bearish on Bitcoin, incidentally. If payment applications broaden, it could easily continue to gain. Still, if one’s motivation for investment to insulate a portfolio from currency depreciation, there’s an argument to buy gold as well. I’m not terribly optimistic about the inflation outlook for 2025, but I will reserve significant opinions until we see how the incoming administration’s policies develop.

Source: Bloomberg, citing FRBNY survey data